Advertisement

Ex-Credit Suisse bankers arrested on U.S. charges over Mozambique loans

NEW YORK (Reuters) - Three former Credit Suisse Group AG bankers were arrested in London on Thursday on U.S. charges of involvement in a fraud involving $2 billion in loans to state-owned companies in Mozambique, U.S. prosecutors said.

Andrew Pearse, 49, Surjan Singh, 44, and Detelina Subeva, 37, were charged in a federal court in Brooklyn, New York, with conspiring to violate U.S. anti-bribery law and to commit money laundering and securities fraud. They have been released on bail in London while the United States seeks extradition.

Former Mozambique finance minister Manuel Chang, 63, was arrested in South Africa this week as part of the same case.

A fifth man, Jean Boustani, was arrested on Wednesday at New York's John F. Kennedy Airport. Boustani is a Lebanese citizen who worked for an Abu Dhabi-based contractor to the Mozambican companies, according to the indictment.

Lawyers for the defendants could not be reached for comment.

"The indictment alleges that the former employees worked to defeat the bank’s internal controls, acted out of a motive of personal profit, and sought to hide these activities from the bank," Credit Suisse said in a statement, adding that the bank would continue to cooperate with authorities.

$2 BILLION IN LOANS

According to the indictment, between 2013 and 2016 three Mozambican state-owned companies borrowed more than $2 billion through loans guaranteed by the government and arranged by Credit Suisse and another investment bank, which was not named in the document.

Apart from Credit Suisse, the Russian lender VTB also arranged financing for Mozambique's state-owned companies. Both Credit Suisse and VTB also arranged a eurobond for Mozambique's government, which is earmarked for restructuring.

VTB and the Mozambican government did not immediately respond to a request for comment.

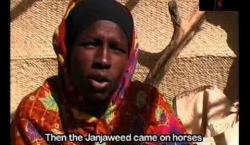

Mozambique - one of the most indebted countries in the world - admitted in 2016 to undisclosed lending, prompting the International Monetary Fund and foreign donors to cut off support, triggering a currency collapse and a default on its sovereign debt. It is still struggling to overcome the resulting debt crisis.

According to the indictment, the three state-owned companies were created to undertake maritime projects, but were really "fronts" for Chang, Boustani and the three bankers to enrich themselves.

Prosecutors said at least $200 million was diverted to the defendants and other Mozambican government officials. They said the defendants concealed the misuse of the funds and misled investors in the United States and elsewhere about Mozambique's creditworthiness.

U.S. TAKES THE LEAD

The companies missed more than $700 million in loan payments after defaulting in 2016 and 2017, the indictment said.

Debt cancellation activists welcomed the arrests, but criticised British authorities for not taking a leading role.

"It is scandalous that it has required action from the U.S. authorities for this investigation and arrests to be made in London," said Tim Jones, a policy officer at the British-based Jubilee Debt Campaign.

"It was the London branches of Credit Suisse and VTB which lent the $2 billion, yet there has been a shocking lack of action taken by UK authorities in holding them to account."

Britain's finance industry watchdog, the Financial Conduct Authority (FCA), started looking at Credit Suisse's involvement in Mozambique in 2016. The FCA declined to comment on the latest events.

Jones also urged Credit Suisse to face up to its own responsibility.

According to the indictment, Pearse was the head of Credit Suisse's Global Financing Group until around September 2013, but had started working for the shipbuilding firm Privinvest Group around April that year. Subsidiaries of Privinvest have been named as primary suppliers to the Mozambican firms.

Singh worked for Credit Suisse as a managing director in the Global Financing Group until February 2017, while Subeva was a vice president in the same department until August 2013.

(Reporting By Brendan Pierson in New York and Karin Strohecker in London; Editing by Dan Grebler, Diane Craft and Kevin Liffey)

Add new comment